The relief was originally offered by the ATO to SMSFs for the 2019-20 and 2020-21 financial years wherecertain situations may have caused SMSF trustees to contravene the superannuation laws.

For example, a SMSF trustee may have provided or accepted certain types of relief, such as giving a tenant/s (including a related party tenant) a reduction in rent if they were financially impacted due to COVID-19. As charging a price that is less than market value will usually give rise to contraventions under the superannuation laws, the relief measures will avoid this outcome if the arrangement meets certain criteria (ie, the relief is offered on commercial terms and the arrangement is documented, etc).

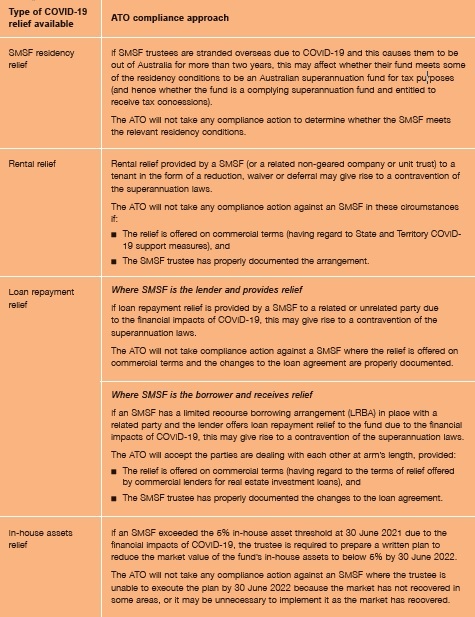

The relief measures available

In September, the ATO announced it would extend several types of relief to SMSF trustees for 2021-22: see table overleaf.

Actions required for SMSF trustees

SMSF trustees must ensure they properly document the relief and can provide their approved SMSF auditor with evidence to support it for the purposes of the annual SMSF audit. When documenting any changes, providing the reasons for change will help the SMSF auditor when they use their judgment to determine whether relief is offered on commercial terms due to the financial effects of COVID-19. It is also good practice to document any changes by way of a minute or a renewed lease agreement or other documentation.

Our Management Credentials