(August is International Dog & Cat Day!)

August isn’t just about the end of winter and tax deadlines — it’s also the month we celebrate International Dog and Cat Day! As tax professionals, we spend a lot of time talking about smart financial choices, and if you’re a pet parent (or thinking of becoming one), it’s the perfect time to talk about budgeting for your furry family members.

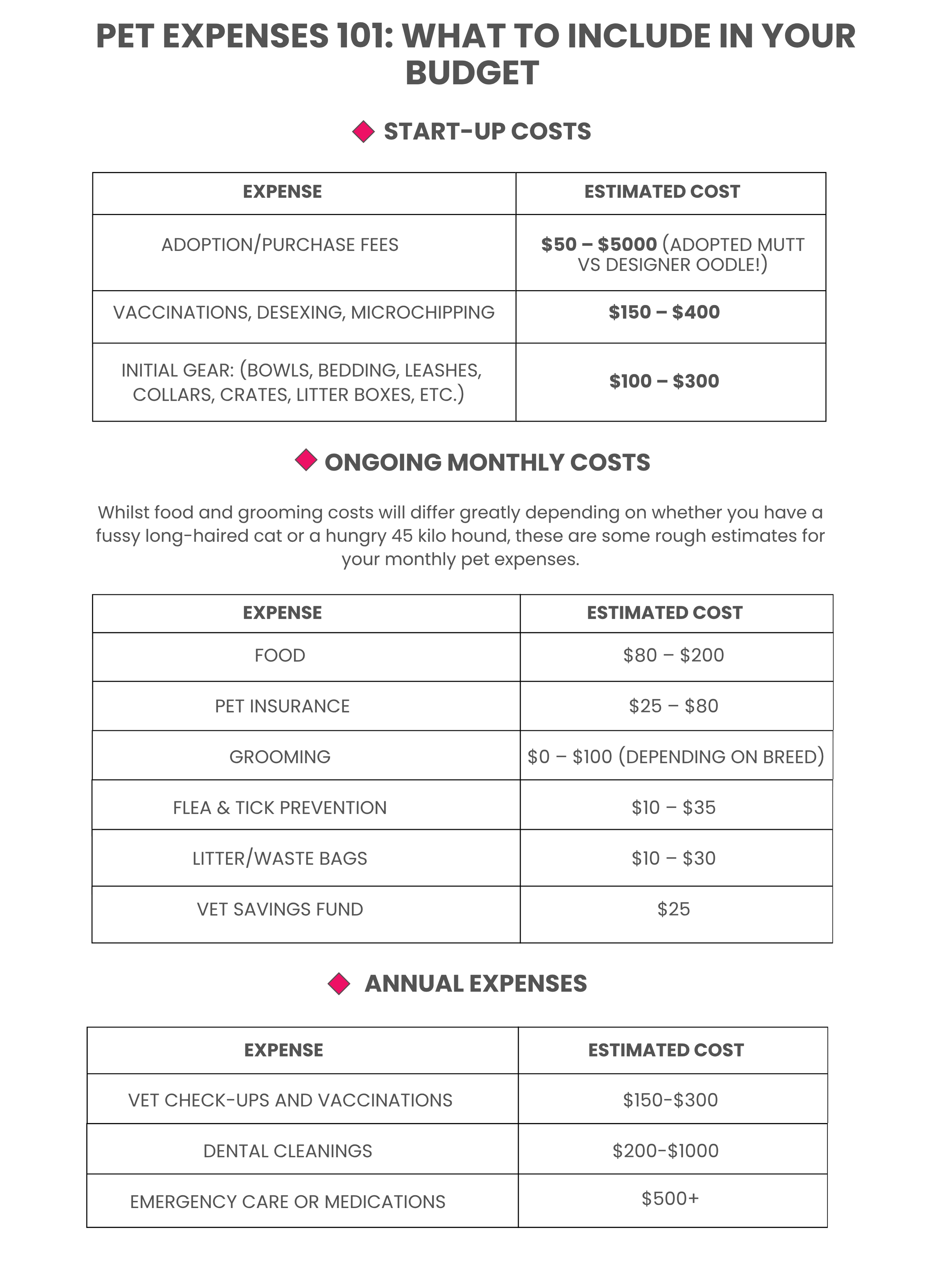

Pets bring endless love and joy, but just like any major life decision, they also come with ongoing financial commitments. Whether you’re a seasoned dog lover or a new cat parent, understanding the real cost of pet ownership can help you plan better — and potentially save money at tax time too (more on that later).

Why Pet Budgeting Matters — Even for Tax-Conscious Households

While the tax office doesn’t consider your Labradoodle a dependent (we wish they did!), budgeting for a pet is just as important as planning for any other household expense. Without a clear budget, it’s easy to underestimate how much your pet really costs.

Proper planning helps you:

- Avoid dipping into savings for unexpected vet bills

- Smooth out monthly cash flow

- Be prepared for emergencies (financial and furry)

- Stay on top of your personal budget — something every good tax agent encourages!

Can You Claim Pet Expenses on Tax?

For most pet owners, pet costs are not tax-deductible — especially if your pet is purely a companion. However, in some specific work-related cases, there may be exceptions:

✅ Working animals – e.g., farm dogs, security dogs, or pest-control cats used in a business

✅ Guard animals for business premises – in limited cases and with documentation

✅ Influencers or content creators – if your pet features in monetised content (think YouTube or Instagram)

Talk to your tax agent if you think your pet plays a role in your business. Documentation and clear evidence of work-related use are key.

Celebrate International Dog & Cat Day (The Smart Way)

This month is a great time to celebrate your pets — but also to assess their financial footprint in your life. Here are some tax-savvy ways to show your love:

- Review your pet budget: Are you spending more than expected?

- Shop smart: Look for discounts on bulk pet food or supplies.

- Consider pet insurance: Unexpected vet bills are one of the biggest financial risks for pet owners.

- Set up a pet emergency fund: Just like you'd save for a car service or medical bill, your pet needs a buffer too.

Final Thoughts: Love with a Ledger

Being a responsible pet owner is about more than cuddles and playtime — it’s about long-term commitment. And from a financial perspective, that means budgeting wisely, planning, and knowing when (and if) your pet expenses could tie into your tax situation.

So, as we mark International Dog and Cat Day this August, take a moment to give your furry friend a treat — and your pet budget a tune-up.

Need help sorting your finances for the new financial year?

Talk to us about personal budgeting, pet-related deductions (if applicable), or setting up funds for life's unpredictable moments.

Our Management Credentials