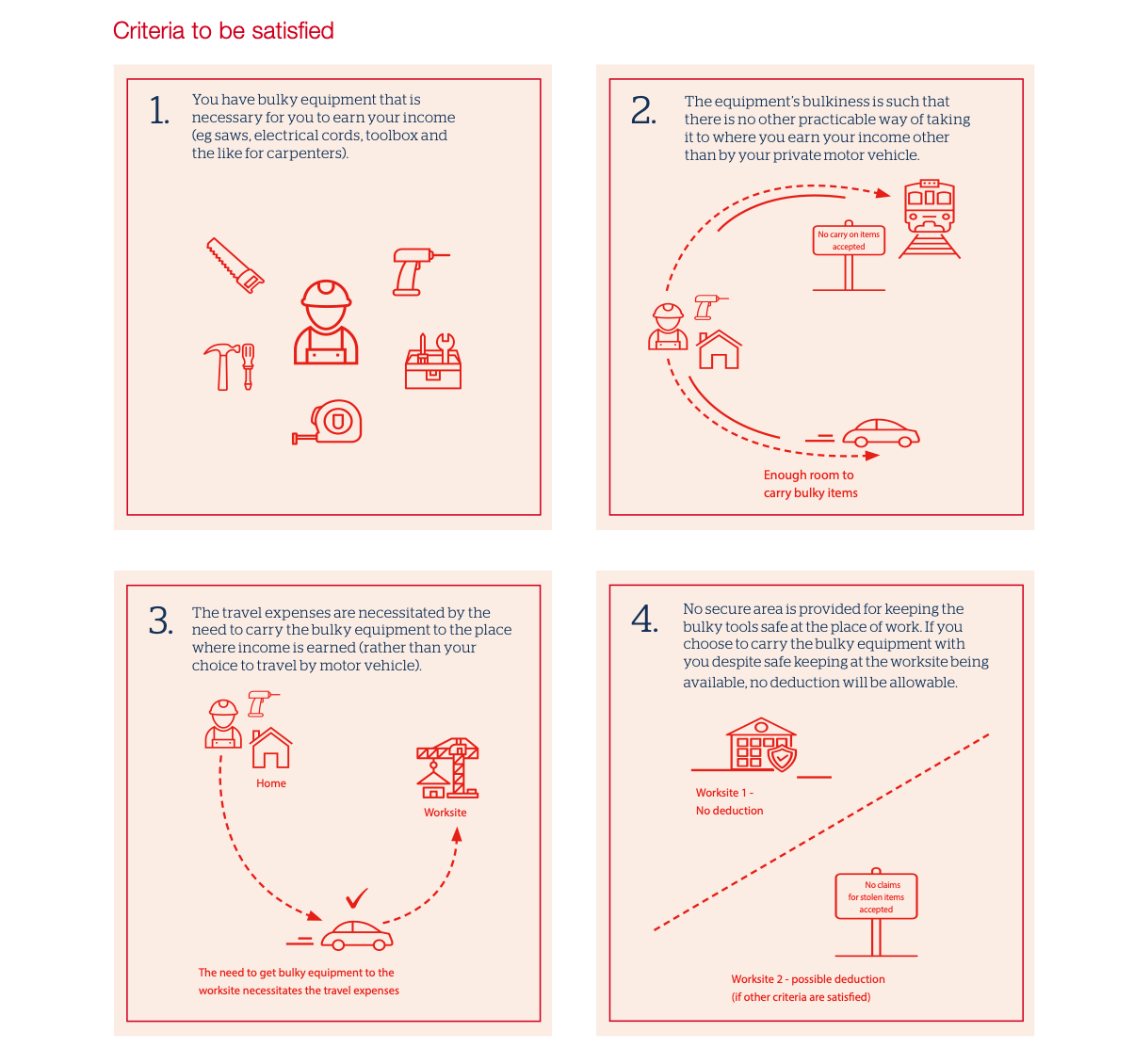

As a general rule, expenses relating to travel between home and work (and vice versa) are non-deductible. A number of exceptions to this principle exist, including for situations that require bulky equipment be transported to and from work. In order for transport expenses to be deductible under this “bulky equipment” exception, it is usually necessary that all of the following conditions are satisfied. The taxpayer will also need to substantiate the expenses by keeping appropriate records of the travel, such as the time, dates, distance, etc.

Tax Store Accountants Footscray.

Our Management Credentials