Sole Traders – No Employees – Not Forgotten

Can apply both business and individual support concessions.

Business Concessions

Instant Asset Write Off $150,000 per Asset to 30 June 2020

Accelerated depreciation for assets $150,000+

- 50% upfront then

- Balance at effective life rate or pooling entry rate

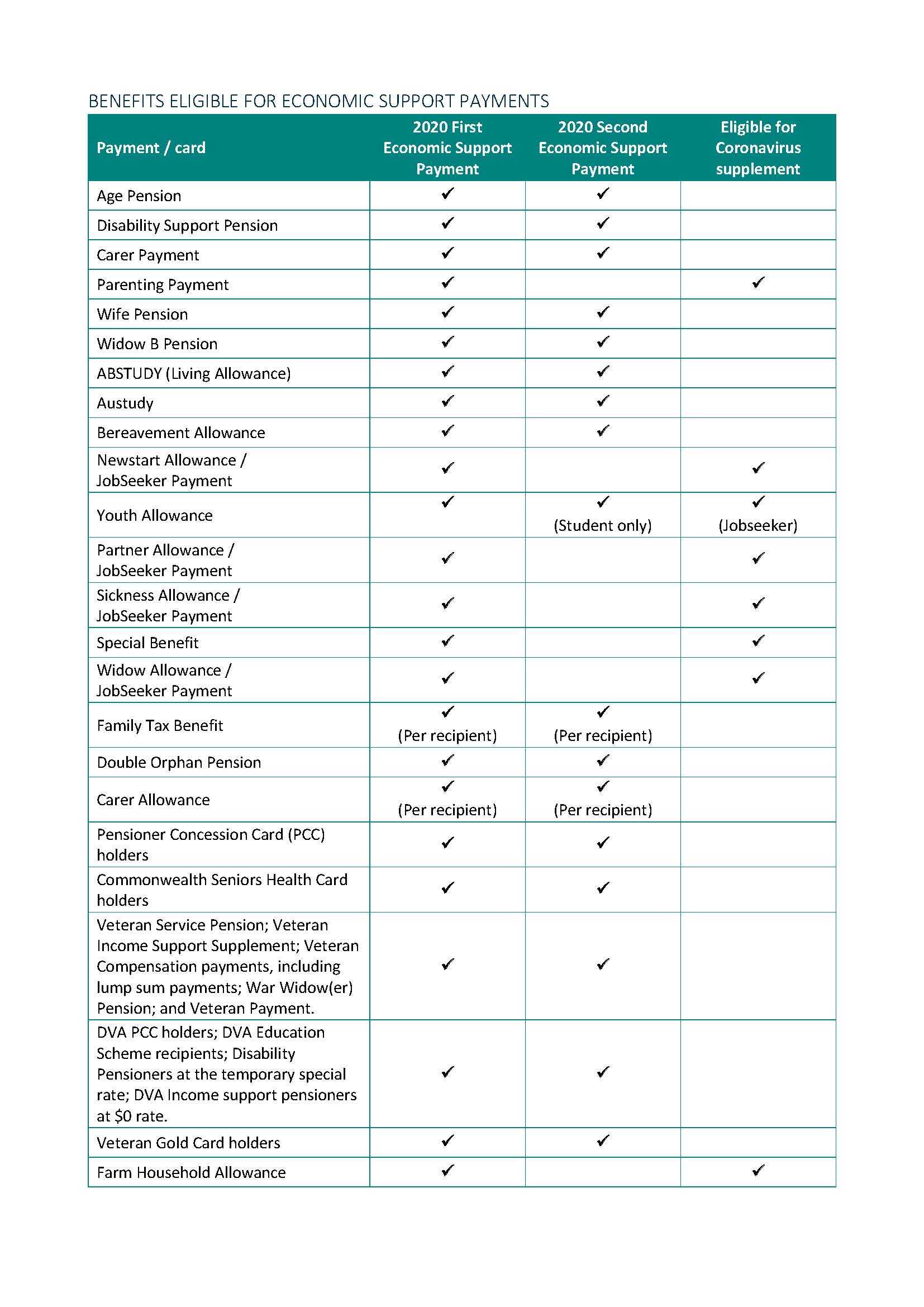

Individual Support Concessions – Receiving Government benefits (see final page)

1st Payment $750.00 from 31 March 2020

If receiving any government benefit or holding a concession card (i.e. Seniors Health Card) from 12 March 2020 to 13 April 2020

2nd Payment$750.00 from 13 July 2020

Eligible to those not receiving the Coronavirus Supplement and receiving government benefits or concession cardholders on 10 July 2020

Payments are tax exempt.

Coronavirus Supplement – $550.00 per fortnight for 6 months from 27 April 2020

Jobseekers, Youth Allowance, Parenting Payment, Farm Household and special benefit recipients.

The supplement is taxable.

Expanded access

For the period of the Coronavirus supplement, there will be expanded access to the income support payments listed above.

• Expanded access: Jobseeker Payment and Youth Allowance Jobseeker criteria will provide payment access for

- permanent employees who are stood down or lose their employment;

- Sole traders;

- the self-employed;

- casual workers; and

- contract workers who meet the income tests as a result of the economic downturn due to the Coronavirus.

- This could also include a person required to care for someone who is affected by the Coronavirus.

• Reduced means testing: Asset testing for JobSeeker Payment, Youth Allowance Jobseeker and Parenting Payment will be waived for the period of the Coronavirus supplement. Income testing will still apply to the person’s other payments, consistent with current arrangements.

• Reduced waiting times:

The one week Ordinary Waiting Period has already been waived.

• Faster Claim Process

• Flexible Jobseeking arrangements

Access to limited exemptions for caring responsibilities, or for people who need to self-isolate, to seek an exemption without medical evidence.

Self-Funded Retirees

Pension minimums halved for

Deeming rates reduced from 1.00% (lower) and 3% (upper) to 0.25% and 2.25% respectively.

Access to 1st and 2nd $750 payment if holding concession cards on relevant dates even if not drawing government pensions.

Other Measures

Early Access to Superannuation

Eligible individuals will be able to apply to access up to $10,000 of their superannuation before 1 July 2020.

They will also be able to access up to a further $10,000 from 1 July 2020 for approximately three months (exact timing will depend on the passage of the relevant legislation).

Eligibility

To apply for early release you must satisfy any one or more of the following requirements:

- you are unemployed; or

- you are eligible to receive a job seeker payment, youth allowance for jobseekers, parenting payment (which includes the single and partnered payments), special benefit or farm household allowance; or

- on or after 1 January 2020: you were made redundant; or

- your working hours were reduced by 20 per cent or more; or

- if you are a sole trader — your business was suspended or there was a reduction in your turnover of 20 per cent or more.

No exit tax and will not affect Centrelink or Veterans’ Affairs payments.

Application is completed via your personal MyGov account.

Land Tax Relief – Victorian State Government

2020 land tax deferred for people that have at least one non-residential property and total taxable landholdings below $1 million.

Our Management Credentials