Five Benefits of Accounting Firms Offering Business Advisory Services

Accounting firms and tax business franchises are offering more than compliance services to cater to their client’s needs and many are now offering additional services such as business advisory.

Read more

Tax Store Australia's 2022 Year In Review

The year 2023 is just around the corner and as we close another fruitful year, we take a moment to reflect on the year that was. Check our latest blog to see the milestones which lead our company towards success.

Read more

Six Essential Skills of Successful Franchise Owners

If you’re interested in operating a tax franchise, you need to know the key traits or skills to become successful with your chosen enterprise. Read it here!

Read more

Three Reasons Why Cloud Accounting Software is Essential for Your Business

Given the challenges and complexities of accounting, we are giving you the three main reasons why you and your accountant need cloud accounting software. Read it here!

Read more

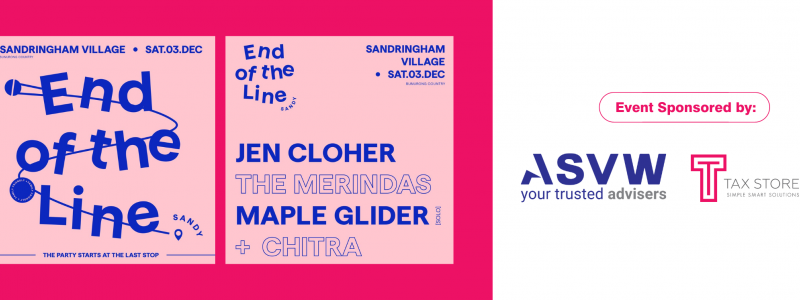

Accountants And Musicians Team Up To Bring Family-friendly Festival Of Music To Bayside Locals

ASVW and Tax Store Australia supports the festival that aims to bring the Bayside Community together for a fun and festive live music event and showcase its distinctive businesses.

Read more

Five Reasons Why You Should Consider a Tax Store Franchise

Starting your own business can be challenging. It’s not about its technical and legal aspects; starting a business – such as a tax franchise – is all about figuring out where to start. Let's discuss the five reasons why you should consider a Tax Store franchise.

Our Management Credentials