What you should know about six member SMSFs

Since the SMSF member limits recently increased from four to six, larger families may be considering having one large superannuation fund for all family members.

Further developments on trust distributions

For the many business owners who operate their affairs through discretionary trusts, there have been

further developments on the ATO’s planned crackdown on certain distributions.

Why super can help save for your retirement

Superannuation is an investment vehicle specifically designed to help you save for retirement - this is one of the key reasons why you should take an interest in your superannuation. Whether you’re employed, self-employed or even nearing retirement, it’s never too late to build up your superannuation to boost your retirement savings.

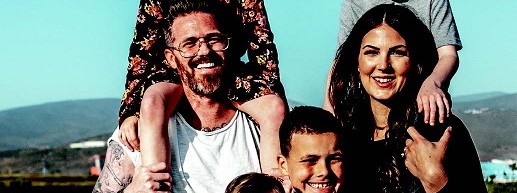

Our parent company ASVW celebrates 10th anniversary – building on success will be the focus

ASVW Holdings (ASVW) co-founder and Director Jose Alguera-Lara has announced that the organisation has achieved a major milestone with the celebration of the group’s tenth anniversary as a national provider of client focused, professional, accounting, legal, financial advice, business advisory and training services.

Read more

Salary sacrificing to super

Are you an employee thinking of putting some of your pre-tax income into superannuation to boost your retirement savings? This is known as salary sacrifice, and the good news is that it can benefit you and your employer.

Ridesharing: The Driver

Uber and other ride-sourcing facilitators have become increasingly popular over recent years. From a

driver’s standpoint, there are a number of tax issues potentially in play. See overleaf for the tax implications from a rider’s perspective.

Our Management Credentials