Splitting superannuation contributions to your spouse can be a great way to boost your combined superannuation balances which can benefit you both in retirement.

What is contribution splitting?

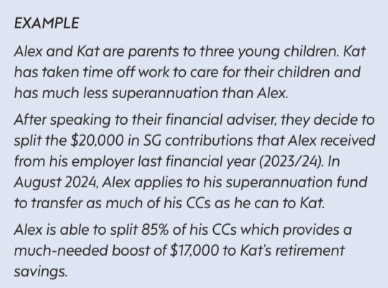

Spouse contribution splitting allows a couple to optimize their superannuation balances by splitting up to 85% of concessional contributions (CCs) they made or received in one financial year (ie, 2023/24) into their spouse’s account the next financial year (ie, 2024/25).

Remember, CCs are before-tax contributions and are generally taxed at 15% within your fund. This is the most common type of contribution individuals receive as it includes superannuation guarantee (SG) payments your employer makes into your fund on your behalf. Other types of CCs include salary sacrifice contributions and tax-deductible personal contributions.

The maximum amount that can be split to your spouse is the lesser of:

■ 85% of CCs made in the previous financial year (ie, 2023/24), and

■ The CC cap for that financial year (ie, $27,500 in 2023/24)

Rules for the receiving spouse

Benefits of contribution splitting

■ Equalising your superannuation balances to make best use of both of your “transfer balance caps” (TBC) which can maximise the amount you both have invested in tax-free retirement phase pensions. Note, the TBC limits the amount that a person can transfer to retirement phase pensions in their lifetime – this limit is currently $1.9 million in 2024/25

Last word

Our Management Credentials