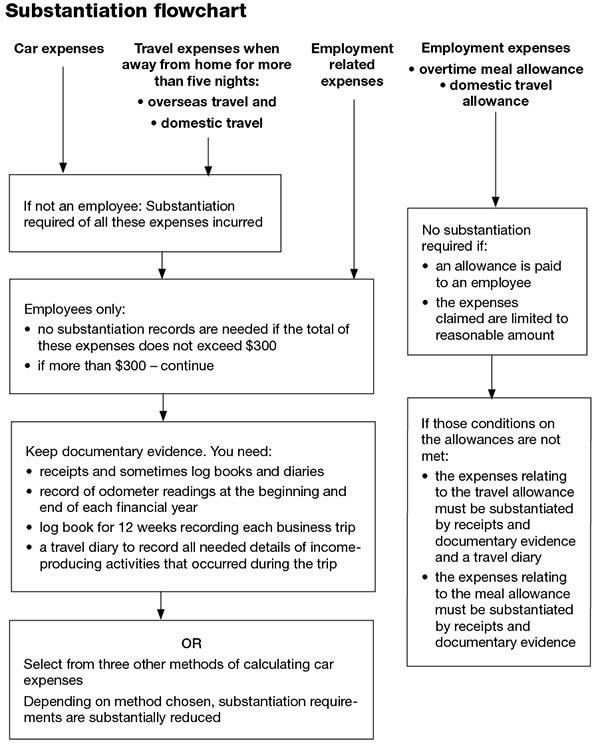

If the claims are to be permitted, they must be substantiated by an individual incurring claims for work-related expenses, car expenses, and travelling expenses (Division 900 of ITAA97). Along with the incur deductible expenditure requirement, strict evidentiary requirement imposed by the “substantiation” rules must be satisfied if claims are to be permissible. or work expense claims.

According to the primary test in s8-1, it is mandatory for the taxpayer to show that relevant expenses were incurred by them and that those expenses were incurred in earning their assessable income, or were incurred in carrying on a business.

The “substantiation rules” levy a mandatory level of record keeping once the primary test has been satisfied (that is, the expense has been incurred and is allowable). The claim may not be allowed in the case those records are not kept.

In regards to work related expenses, business travel expenses and car expenses calculated under the log book method, Subdivision 900-H (see TR 97/24) states that there would be a grant of relief where expenses have not been substantiated if:

- there is sufficient evidence to satisfy the ATO that a deductible expense was incurred

- there was a reasonable expectation substantiation was not needed, or

- documents were lost or destroyed after reasonable precautions had been taken and reasonable efforts are made to get a substitute document (unless not reasonably possible).

This is applicable for individuals and partnerships where at least one partner is an individual. Strict substantiation rules have been modified by the ATO to account for technology changes and the way taxpayers pay for and record financial information.

See the substantiation flowchart below.

Tax Store Accountants Mackay.

Tax & Super Australia: Substantiation for work expense claims

Our Management Credentials